Why Hasn’t the Ealing Property Market Crashed?

The UK property market has demonstrated remarkable resilience despite facing significant challenges over the past 18 months. Many analysts in the autumn of 2022 predicted a severe downturn in house prices, driven by economic uncertainty, a cost-of-living crisis, and rising mortgage rates.

Yet, contrary to these grim forecasts, UK (and Ealing) house prices have remained relatively stable. This article delves into the reasons behind the unexpected stability of the property market, providing insights for buy-to-let landlords and homeowners alike.

Economic Predictions vs Reality

In the autumn of 2022, following the controversial Liz Truss and Kwasi Kwarteng mini budget, there were widespread predictions of a dramatic fall in UK house prices. Some forecasts suggested a potential decline of between 20% and 35%. However, these predictions have yet to materialise. While there has been a slight drop in prices since their peak in autumn 2022, the decrease has been modest, with official Land Registry figures indicating a fall of about 3.12% in UK house prices in the last 18 months.

Yet if we look at the last 12 months, British house prices according to the Land Registry were 0.89% higher in April 2024 than April 2023. Yet the issue with Land Registry data is that by its very definition, it is 6 to 8 months out of date, as it measures house prices agreed 6 to 8 months before that data is published.

Data from Denton House Research using live real time data of £/sq.ft sales agreed statistics indicate UK house prices on the 97k sale agreed homes in May 2024 stood at £348/sq.ft.

For comparison, in April 2024 it was £344/sq.ft, in March 2024 and February 2024 it was £339/sq.ft and in January 2024 it was £331/sq.ft, a rise of 5.13% since the New Year.

This resilience raises the question: Why were the forecasts so inaccurate?

Improved Lending Practices

One significant factor that has helped stabilise the property market is the improvement in lending practices. During previous housing market downturns, banks often came under fire for poor lending standards. However, changes to mortgage regulations in 2014 with the Mortgage Market Review (MMR) have made a considerable difference this time. These regulations require banks to ensure borrowers can afford their monthly repayments even if mortgage rates increase significantly. This precaution has provided a substantial buffer for homeowners, enabling them to cope with rising rates.

For instance, in 2007, shortly before the global financial crisis, many borrowers did not need to prove their income to their banks. The 2014 MMR changes addressed this issue, ensuring that lending was based on sound financial footing. Consequently, many homeowners could afford higher mortgage payments when their mortgage rates increased recently.

Employment and Wage Growth

Another crucial element has been the relatively stable employment situation. Although the UK experienced a brief recession over this last winter, unemployment rates have remained low at 4.3%, compared to 8.5% during the 2008 global financial crisis. Moreover, average wages (including bonuses) have increased by 5.7% over the past year, reaching their record-high level of £682 per week.

This combination of low unemployment and rising wages means that fewer homeowners have been forced to sell their properties due to financial difficulties. Even those facing financial challenges have found support from proactive banks, which have offered solutions such as interest-only payments or extended mortgage terms to help them manage their repayments.

Supply and Demand Property Market Dynamics

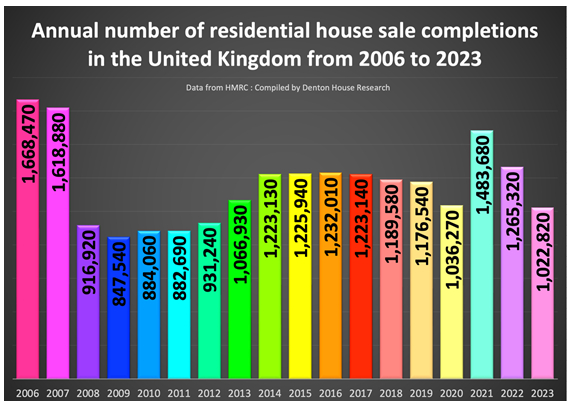

The impact of economic challenges on the property market has been more evident in transaction volumes than in prices. Typically, there are about 1.16 million house sale completions annually in the UK. However, this number surged to 1.48 million in 2021 due to the lockdown inducing ‘race-for-space’. It then dropped to 1.26 million in 2022 and further to 1.02 million last year.

While demand has decreased because of higher mortgage costs, supply has also reduced as potential sellers have chosen to wait for better market conditions.

There was an 11.5% increase in net house sales in the first five months of 2024 compared to the first five months of 2023 (400,697 UK net house sales YTD to 26th May 2024 vs 359,523 UK net house sales), but only a 9.9% rise in new homes coming to the market (745,715 UK listings YTD to 26th May 2024 vs 678,845 UK listings).

First-Time Buyers and the Rental Market

First-time buyers have been particularly affected by rising mortgage rates, as they typically need to borrow a larger proportion of their home's value. Despite this, they have been more active than expected, partly due to the rapid rise in rental prices. High rental costs have motivated many to purchase homes, often with financial help from their families. Data from the English Housing Survey revealed that just over 11 out of 30 first-time buyers received financial gifts from their families in the past year, up from 8 out of 30 in 2022. This support has played a vital role in maintaining activity in the housing market.

Ealing Property Market

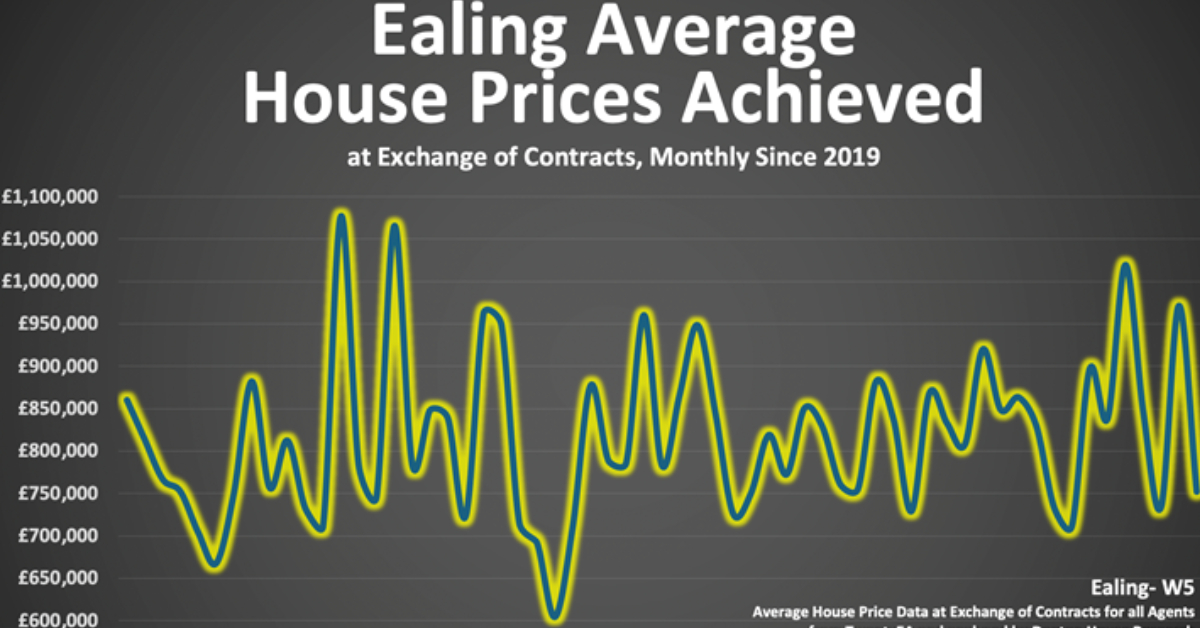

So how is all this affecting the Ealing property market? One measure is judging what people are paying for Ealing homes.

Looking at the monthly exchange of contracts data, the average price paid from May 2019 to April 2020 for an Ealing home (W5) was £767,337. The average price paid in the last year (June 2023 to May 2024), has been £837,031, a growth of 9.08%.

Now, it is important to stress, this does not mean Ealing house prices have risen by 9.08%, just the average price paid between the two 12-month periods has changed. Over the coming weeks and months, we will be analysing the £/sq.ft data for Ealing and reporting back in the Ealing Property Blog.

Outlook for House Prices

Eighteen months ago, economists almost unanimously predicted a decline in house prices. Now, many are forecasting growth. Estimates vary, with some predicting a 4% increase, although this might be optimistic. Other estimates suggest a 3% rise, while some analysts expect prices to remain broadly flat this year due to stretched affordability, especially for first-time buyers.

The UK property market has shown an impressive ability to weather economic storms, thanks to sound lending practices, stable employment, rising wages, and family support for first-time buyers. Whilst transaction volumes have taken a hit from the heady days of 2021 and the long-term average, this has meant, along with the other factors mentioned in the article, house prices have remained more stable than many predicted.

If you are wondering about the general election’s effect on the property market, it is our belief it will have hardly any effect on the medium-term direction of the property market (on assumption neither of the main parties have any ‘creative and wacky’ policies not yet published at the time of writing this article).

So, as we progress into the second part of 2024 and beyond, the property market's resilience will continue to be tested, but the foundations laid in recent years provide a solid base for navigating future challenges.

Author Homesearch

Looking to buy?

We'd love to help you on your journey home.

Don't miss out on on the latest properties by registering for our property alerts.

Read What Our

Customers Say

Expert Valuation

We always come armed with evidence and statistics of why we are pricing your property a certain way. We know the importance of getting the initial price of your property right, first time. With our extensive experience we will also explain current market conditions as we want to get our sellers the best price.

What's more, get a free gift with your free expert valuation with one of our experienced Valuer's.

Book a Valuation