Ealing Property Market: Where are the Cash Buyers?

Ealing Property Market:Where are the Cash Buyers?

The UK property market has undergone significant shifts since the summer of 2020, driven primarily by the post lockdown race between the summer of 2020 and late 2021, and then a rapid series of interest rate hikes aimed at curbing inflation in 2022 and 2023. These changes have had far-reaching implications across the property market, influencing both prices and transaction volumes.

As we explore the nuances of these facts, it has become evident that while some anticipated trends (the property market was supposed to crash in Covid and again on the interest rate rises), this did not fully materialise. In fact, the property market has shown remarkable resilience under pressure.

The Interest Rate Surge and Its Impact

The initial wave of interest rate hikes began in November 2021, as the Bank of England sought to counter rising inflation, a process that continued until the summer of 2023. Over this period, interest rates were raised 14 times, culminating in a peak rate of 5.25%. The Bank of England's decision to implement such a rigorous monetary policy stemmed from concerns about the rapidly escalating cost of living, a consequence of both domestic and global economic pressures, including the significant disruption caused by Russia's invasion of Ukraine in February 2022.

However, the interest rate tide began to turn in August 2024 when the Bank cut rates slightly, to 5%, in response to improving inflation figures. This reduction, coupled with signs that further cuts could be on the horizon, has brought a sense of cautious optimism to the market. For the first time in many months, there is a glimmer of hope that the worst of the economic storm may be behind us.

So, let us look at house prices locally over the last 4 years.

Local Property Market House Prices in Ealing Between 2020 and 2024

The average value of a property in Ealing in July 2020, was £473,622. Today, according to the Land Registry, that now stands at £535,734, a rise of 13.11%. So, house prices in the Ealing area as a whole haven’t dropped, despite the two predictions they would. So surely, it must be cash buyers that kept the Ealing property market afloat, considering the huge increases in interest rates?

Cash Buyers: Not the Game-Changer We Expected

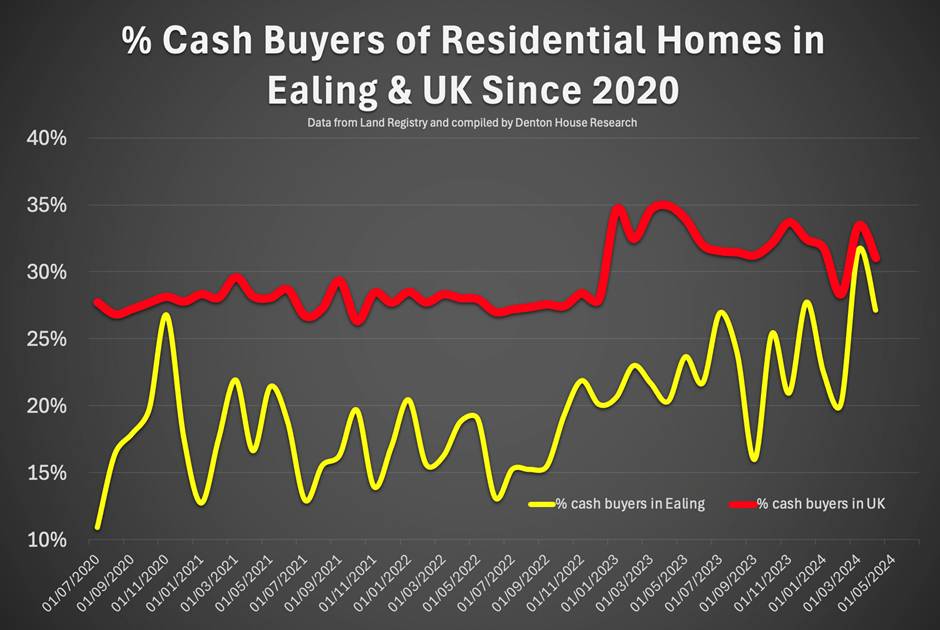

In analysing the performance of different segments of the British property market during this tumultuous period, one of the more surprising findings is the limited role that cash buyers have played. Traditionally, cash buyers are perceived as having a significant advantage in a high-interest-rate environment. Without the need for financing, they are insulated from the direct effects of rising borrowing costs, which should, in theory, allow them to dominate the market when mortgage rates soar. So, did the number of cash buyers rise when interest rates began to rise in 2022?

The proportion of UK home buyers with cash has indeed risen from the late 20%’s in 2020/21 to the early 30%’s in 2023/24.

As you can see it increased, yet it wasn’t an avalanche. Despite their financial advantages, cash buyers did not dramatically alter the dynamics of the market. Instead, the pace of the market continued to be set by those who rely on mortgages, even as the cost of borrowing increased substantially. This trend underscores the critical role that mortgaged buyers play in shaping market conditions.

Looking locally in Ealing:

- In 2020, 27.57% of UK home buyers were cash buyers, whilst in Ealing, 18.2% of buyers were cash buyers.

- In 2021, 28.06% of UK home buyers were cash buyers, whilst in Ealing, 17.0% of buyers were cash buyers.

- In 2022, 27.79% of UK home buyers were cash buyers, whilst in Ealing, 17.5% of buyers were cash buyers.

- In 2023, 32.94% of UK home buyers were cash buyers, whilst in Ealing, 22.6% of buyers were cash buyers.

- In 2024 YTD, 31.15% of UK home buyers were cash buyers, whilst in Ealing, 25.3% of buyers were cash buyers.

Locally in Ealing, we also saw a growth in cash buyers – yet again, nothing groundbreaking!

Mortgage Stress-Testing and Market Stability

So why were the doom mongers wrong about the property market crashing due to the vast increase in mortgage rates? This was down to the effectiveness of the Mortgage Market Review stress-testing rules introduced in 2014 for borrowers after the global financial crisis of 2008. These rules, designed to ensure that borrowers could withstand higher interest rates, have been instrumental in maintaining stability in the property market. Even as mortgage rates more than quadrupled from their lows, over three quarters of UK’s local authorities saw house prices increase between the spring of 2022 and the spring of 2024.

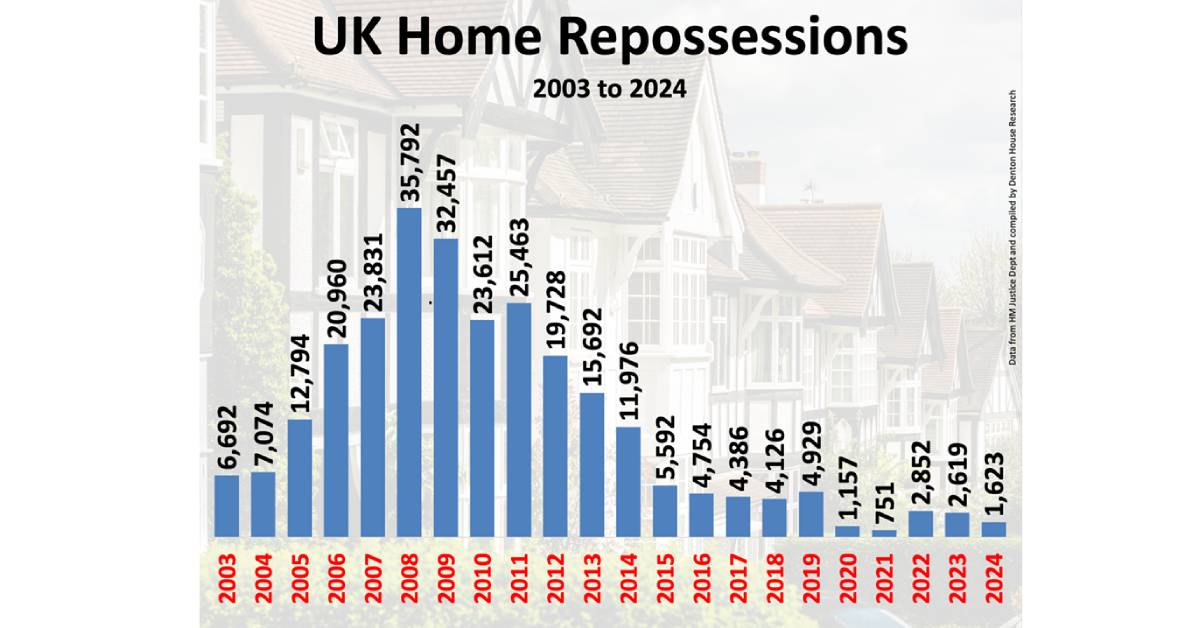

This stability is further evidenced by the relatively low levels of repossessions compared to the aftermath of the global financial crisis. In the 4 years after the global financial crash (2008 to 2011 inclusive), 113,374 UK were repossessed. In the Covid years of 2020 to 2023 inclusive, that number was 7,379 UK households.

Strong wage growth (average UK wages have risen from £31,487pa in 2020 to £35,828pa) and lender forbearance has also played vital roles in supporting borrowers during this challenging period.

These factors have collectively prevented the kind of widespread distress that many feared would occur as rates climbed.

Affordability and the Shift in Buyer Preferences

While house prices have remained robust in most areas, affordability has continued to be a significant concern for buyers, particularly in more expensive urban markets such as London. The pandemic-induced ‘race for space’ accelerated a trend where financially constrained buyers sought more affordable properties outside major cities. This migration from urban centres to more suburban or rural locations has been a defining characteristic of the property market over the past few years, and it appears to have gained further momentum as rates rose.

In more expensive locations, where the cost of living and property prices were already high, the increase in mortgage rates has made buying a home even more challenging for many. As a result, these areas have seen a shift in buyer demographics, with those less affected by higher rates—such as wealthier individuals or those moving from more affordable regions—continuing to purchase, while others have been priced out.

Sales Volumes vs. Prices: A Complex Relationship

As we evaluate the overall performance of the UK housing market, it's evident that while property prices have remained relatively strong, sales volumes did see a decline in 2023 compared to the surge witnessed in 2021. In 2021, transactions peaked at approximately 1.4 million, a significant increase compared to previous years. However, by 2023, this figure had decreased to around 1.02 million.

Despite the rise in interest rates during 2023, its transaction levels were consistent with long-term trends (there were an average 1.06 million transactions per year between 2008 and 2019). This stability highlights the resilience of the housing market. 2024 projections suggest that transactions may reach approximately 1.15 million, indicating a stable property market that continues to align closely with historical norms, even amid current economic conditions.

The persistence of strong prices, despite lower transaction volumes, suggests a degree of pent-up demand. If Ealing buyers perceive that interest rates have stabilised or are beginning to decline, we could see a significant increase in transaction activity. This potential recovery is likely to be most pronounced in regions where affordability remains a key factor, and where the desire for more space continues to drive buyer behaviour.

Looking Ahead: A Pivotal Moment for the Ealing Market

As we move forward, the UK property market appears to be at a crucial juncture. It is showing encouraging signs as we move through the latter half of 2024. With listings up by 7.2% year-to-date compared to pre-pandemic averages and gross sales 22% higher than the same time in 2023, the market is demonstrating resilience. Net sales have also surged, with a 28% increase compared to the same period last year, reflecting strong buyer activity. Additionally, the slight 2.6% rise in sale prices per square foot from January to July 2024 indicates a steady demand for property. These positive trends suggest a robust market outlook as we progress through the year.

Coupled with the recent rate cut, and better-than-expected inflation figures, this may signal the beginning of a more stable period. If financial markets are correct in predicting further rate cuts by the end of the year, we could see renewed confidence among buyers, leading to a more robust recovery in sales volumes.

However, it’s essential to recognise that the landscape has changed. The experience of the past four years has reinforced the importance of affordability, the resilience of stress-tested borrowers, and the critical role of mortgage buyers in setting market dynamics. As estate agents, understanding these shifts is crucial in navigating the evolving market and advising clients effectively.

As an Ealing homeowner looking to sell, it's crucial to approach the market with a realistic mindset. With only 53% of properties that come onto the market successfully reaching a completed house sale and move, the odds of selling can feel like a flip of a coin, (12 months to 23rd August 2024, of the 1,420,486 homes that left UK estate agents books, 798,886 homes exchanged and completed, and 710,620 homes withdrew unsold).

To ensure you're on the right side of that coin, it's vital to set a competitive price and present your property in the best possible light as this can significantly increase your chances of securing a sale and achieving your moving goals.

In Ealing and similar towns and cities, where affordability and the search for space are particularly relevant, the insights gained from this period of upheaval will be invaluable. By staying attuned to these trends and anticipating the needs of our Ealing clients, we can offer informed guidance in a time of change.

In conclusion, while the past four years have been challenging for the Ealing and UK property market, they have also demonstrated its underlying strength and adaptability. As we potentially enter a more stable period, there is cause for cautious optimism. By understanding the factors that have shaped recent performance, we can better navigate the road ahead and continue to support our clients through whatever challenges and opportunities the future may hold.

If you would like to discuss anything about the Ealing property market, please not hesitate to call us at the office.

Author Homesearch

Looking to buy?

We'd love to help you on your journey home.

Don't miss out on on the latest properties by registering for our property alerts.

Read What Our

Customers Say

Expert Valuation

We always come armed with evidence and statistics of why we are pricing your property a certain way. We know the importance of getting the initial price of your property right, first time. With our extensive experience we will also explain current market conditions as we want to get our sellers the best price.

What's more, get a free gift with your free expert valuation with one of our experienced Valuer's.

Book a Valuation