Ealing Property Market – Is There a ‘New Build Premium’?

Ealing Property Market – Is There a ‘New Build Premium’?

An Ealing landlord recently asked me why the brand new property she was considering was more expensive than a similar second-hand home in the same location. It's a common question, and many homeowners and landlords in Ealing have likely pondered it.

So, I decided to dig into the data to uncover the truth behind the 'new build premium'—and the latest statistics offer some fascinating insights.

Why Do New Builds Cost More?

At first glance, the price difference between a new build home and an existing property might seem to be down to personal preference. Some buyers (and tenants) prefer a new home's fresh, modern feel, while others favour the character and reliability of a property that has stood the test of time. But is there more to it than taste?

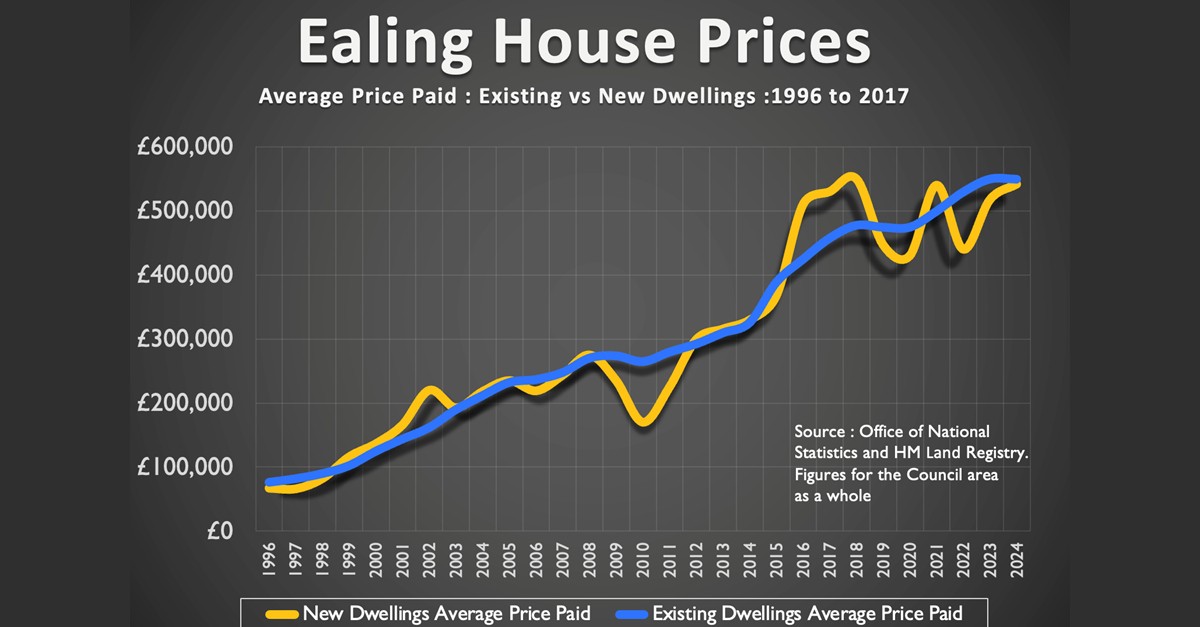

Looking at the average price paid for existing (second-hand) homes versus new build properties in Ealing since 1996, a clear trend emerges: new build homes command a significant premium.

- Between 1996 and 2008, the average newly built home sold for £4,968 more than an existing Ealing home.

- Yet, between 2008 and 2013, the average newly built home sold for £20,587 less than an existing Ealing home.

- Since 2013, the average newly built home has sold for £4,355 more than an existing Ealing home.

Over the past 29 years, the average—the additional amount buyers pay for a newly built home compared to a second-hand one—has been 0.2% less. However, if we look at the last 10 years, that is 1.3% more.

The ‘new build premium’ refers to the additional price buyers pay for a newly constructed home compared to a similar second-hand property. Factors such as modern design, energy efficiency, and developer incentives contribute to this price gap. However, the premium fluctuates with market conditions—rising in a strong market when demand is high and shrinking in tougher times when buyers have more negotiating power. Understanding this trend can help buyers and investors make more informed decisions about when and what to buy.

Looking to buy?

We'd love to help you on your journey home.

Don't miss out on on the latest properties by registering for our property alerts.

Read What Our

Customers Say

Expert Valuation

We always come armed with evidence and statistics of why we are pricing your property a certain way. We know the importance of getting the initial price of your property right, first time. With our extensive experience we will also explain current market conditions as we want to get our sellers the best price.

What's more, get a free gift with your free expert valuation with one of our experienced Valuer's.

Book a Valuation