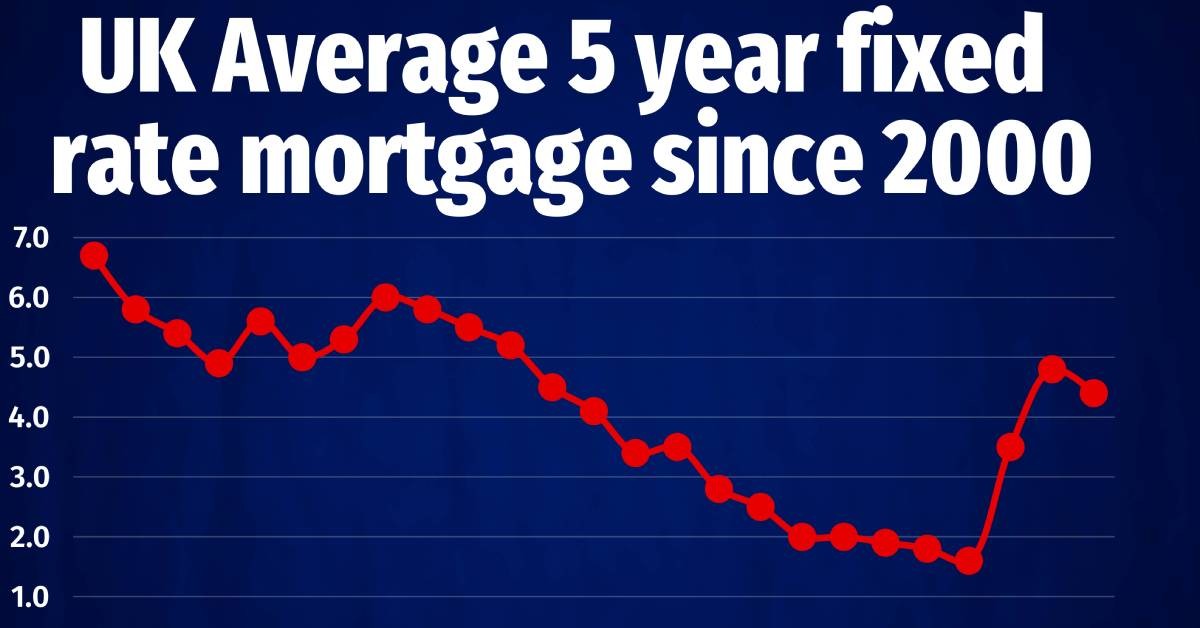

Average Mortgage Rates since 2000

Average Mortgage Rates since 2000

The graphic illustrates the average five-year fixed rate mortgage in the UK since 2000, highlighting significant fluctuations over the past two decades. Following the credit crunch, mortgage rates experienced a considerable decline, reaching historic lows in the subsequent years. However, recent economic conditions and inflationary pressures have caused a sharp rise in these rates. Despite this increase, current rates remain well below the peaks seen in the 1990s, when they soared to 14.88%.

The importance of mortgage rates cannot be overstated, as they directly influence the affordability of property purchases and the broader health of the housing market. The Bank of England's anticipated rate cuts in the coming months are promising for prospective buyers, as lower mortgage rates can significantly reduce monthly repayments, making home ownership more accessible.

The importance of mortgage rates cannot be overstated, as they directly influence the affordability of property purchases and the broader health of the housing market. The Bank of England's anticipated rate cuts in the coming months are promising for prospective buyers, as lower mortgage rates can significantly reduce monthly repayments, making home ownership more accessible.

Author Homesearch

Looking to buy?

We'd love to help you on your journey home.

Don't miss out on on the latest properties by registering for our property alerts.

Read What Our

Customers Say

Expert Valuation

We always come armed with evidence and statistics of why we are pricing your property a certain way. We know the importance of getting the initial price of your property right, first time. With our extensive experience we will also explain current market conditions as we want to get our sellers the best price.

What's more, get a free gift with your free expert valuation with one of our experienced Valuer's.

Book a Valuation